What you need to know about Concurrent Receipt (a.k.a. Dual Compensation)

- Published:

- Last Updated: July 17, 2023

What is Concurrent Receipt?

Concurrent receipt, also known as “dual compensation,” occurs when you receive both retirement/separation money from the DoD and disability money from the VA.

Concurrent receipt is legally not allowed (with exceptions, discussed below).

Disability compensation from the VA is a type of retirement benefit, so if you are receiving it along with your retirement pay from the DoD, then you are technically receiving your retirement benefits twice (“dual compensation”).

How does VA Disability affect my Separation/Severance Pay?

When you are separated from the military, you receive a single lump sum payment upon discharge.

If you later apply for VA Disability and start to receive benefits from the VA, you will have to repay your separation payment. Depending on how long ago you were separated, this could be a difficult prospect as it is unlikely that you have that money sitting in a bank.

Because of this, the VA will instead recoup the payment by withholding it from your first disability payments.

So if you owe $10,000 and start receiving monthly disability benefits of $1,000, then the VA will simply not pay you for the first 10 months ($1,000 x 10 = $10,000).

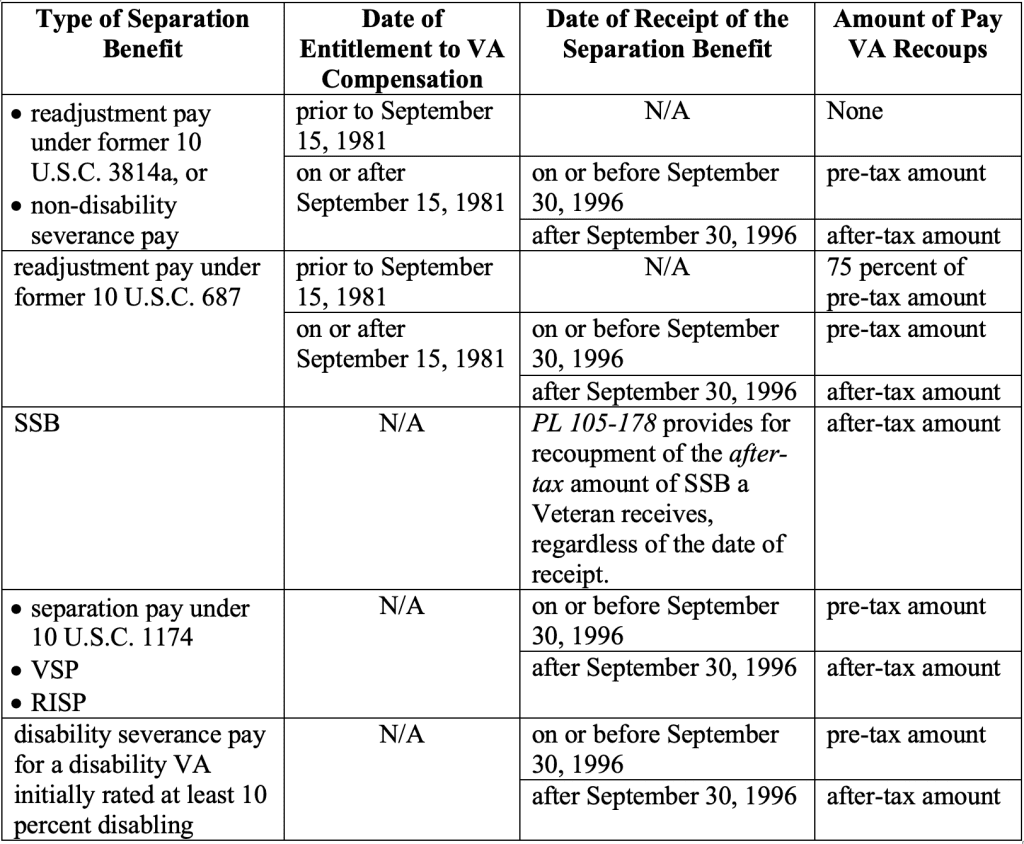

Laws have changed over the years regarding when and how much the VA can recoup your separation pay. The following table lists the different types of separations/severances, pertinent dates for each, and what the VA will recoup.

In the table you will notice that in some instances, the VA will recoup the pre-tax amount and in other instances, they will recoup the after-tax amount. All money paid by the DoD is taxable, so based on this table, the VA will either recoup on the amount you received before you paid taxes or on the amount you received after you paid taxes.

How does VA Disability affect my Retirement Pay?

When you are retired from the military, whether standard or disability retirement, you receive monthly payments for the rest of your life.

If you then apply for VA Disability benefits, you cannot receive from the VA the amount you are receiving from the DoD. Instead, the amount you receive from the DoD will decrease by the amount you are receiving from the VA.

So if you are receiving $500/month from the DoD and start to receive $300/month from the VA, then your DoD payment will decrease to $200/month ($500 – $300 = $200). You will then receive $200/month from the DoD and $300/month from the VA.

Similarly, if you are receiving $500/month from the DoD and start to receive $1,000/month from the VA, you will simply stop receiving payments from the DoD and receive $1,000/month from the VA.

In both scenarios, you still receive the full retirement benefit, but as much of the money as possible will come from the VA instead of the DoD. This is great in that VA money is not taxable, so you will no longer be paying taxes on your retirement benefits by receiving them from the VA.

Is Concurrent Receipt ever allowed?

Yes! There are two programs that allow concurrent receipt if you meet certain requirements: Combat Related Special Compensation (CRSC) and Concurrent Retirement and Disability Pay (CRDP).

Both programs allow you to receive your retirement money from the DoD along with your disability money from the VA.

Combat Related Special Compensation (CRSC) is available to retired service members who acquired their conditions in combat. If you qualify, you must submit an application for CRSC.

Concurrent Retirement and Disability Pay (CRDP) is available to retired (non-disability retirement) service members with a 50% or higher rating from the VA. You do not have to apply for CRDP. It will be given automatically if you qualify.

Read more about CRSC and CRDP to see if you qualify and how to apply.

Recent Posts

TDRL vs. PDRL—Which is better for disability benefits?

Leukemias and Multiple Myelomas NOW on the Presumptive List

Two MORE Conditions added to the Burn Pit Presumptive List

The 2025 VA Disability Rates are here!

About Us